Open Banking Software: Imagine a reality where your financial data flows seamlessly between banks, fintech companies, and other financial services, all while you remain in control. That’s the promise of open banking software and it’s actually as close to our reality as you can come. It’s revolutionizing how users can manage money, offering unprecedented transparency and convenience.

In the UK, open banking has gained significant traction, driven by regulatory changes and technological advancements. But what exactly is open banking software, and why should you care? This article will delve into the ins and outs of this transformative technology, exploring its benefits and potential pitfalls. Whether you’re a tech-savvy consumer or a financial professional, understanding open banking software is crucial in today’s digital economy.

Understanding Open Banking Software

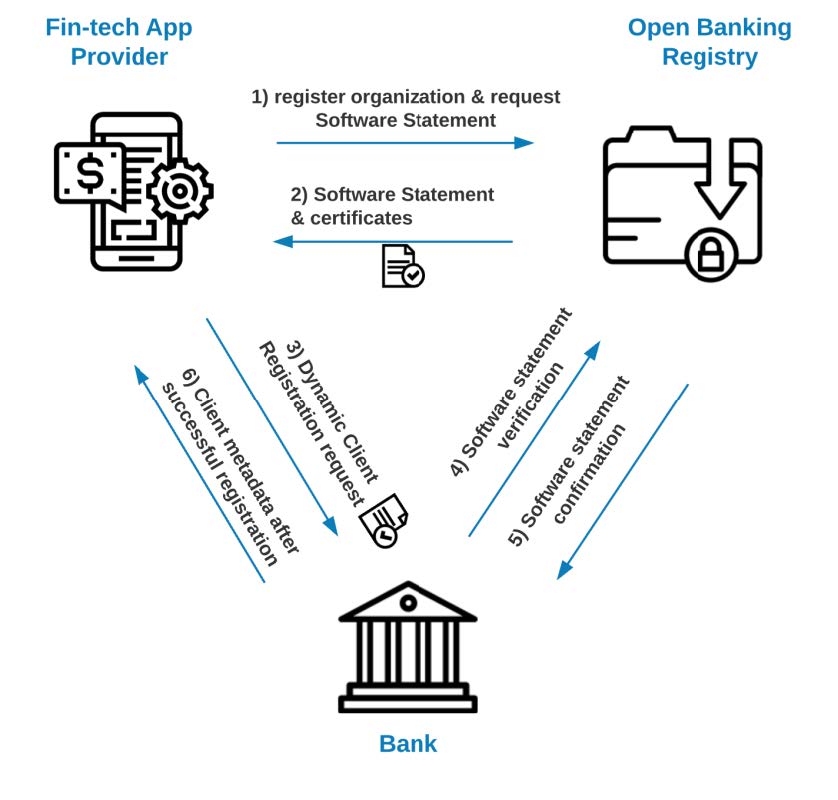

Open banking allows third-party developers to access financial data from banks and other financial institutions with customer consent. This access enables the development of innovative financial products and services, enhancing customer experience and promoting competition.

The UK was an early adopter due to the PSD2 regulation, encouraging banks to share data securely. You might ask, how does this affect me? Imagine easier access to unsecured business loans or quick budgeting tools. It’s all about providing more options and transparency.

Key Features of Open Banking Software

Open banking software has unique attributes that set it apart:

- Security Protocols: Ensures data privacy through advanced encryption.

- APIs: Application Programming Interfaces facilitate data sharing between banks and third-party developers.

- User Consent Management: Involves user-permission systems to control data sharing.

- Real-time Data Access: Provides up-to-date financial information.

This software focuses on providing secure, user-friendly interfaces for consumers and financial institutions. With real-time data access, any query, whether it’s unsecured business loans or expenditure tracking, gets answered quickly. These features make open banking a robust and essential tool in modern finance.

Benefits of Open Banking Software

For Consumers

Open banking software is like having a superpower for managing your money. Imagine you have instant access to all your financial info in one place. No more juggling between apps. It’s straightforward budgeting heaven. With user-friendly interfaces, you can track spending patterns and identify ways to save. Got too many party nights affecting your budget? You can spot that quickly.

Such software enables real-time data access, meaning you’re always looking at the freshest info. This transparency helps in making informed decisions. Whether it’s comparing financial products or tracking transactions, you’re in control. And don’t fret about security. With robust security protocols and user consent management, your data stays safe.

For Businesses

For businesses, open banking software transforms how you handle finances. If you’re looking for unsecured business loans, it simplifies the process. With data at your fingertips, you can present a clear financial picture to potential lenders. This could lead to faster approvals and better loan terms.

Integration with APIs means seamless interaction with other financial tools. You get real-time insights into cash flow, helping you manage finances more effectively. Planning a major purchase or expansion? The software’s analytics can guide you.

Competition heats up as businesses can offer more innovative products, giving you fresh ways to engage your customers. And guess what? The transparency doesn’t just help consumers. It builds trust and loyalty, which are gold for any business.

Open banking software is like having a secret weapon. It better connects you to your finances, driving smarter decisions. Whether you’re a consumer or a business, the benefits are tangible and numerous.

The Challenges and Solutions of Open Banking

Security Concerns

In the world of open banking, security isn’t just a perk, it’s a mandate. With the rise of cyber threats, protecting sensitive financial data is paramount. Open banking software employs advanced security protocols like OAuth 2.0 and OpenID Connect to ensure that only authorized entities can access data. Are you worried about your financial data falling into the wrong hands?

Reputable open banking platforms also utilize AI-powered anomaly detection to flag suspicious activities in real-time. This helps in nipping potential breaches in the bud. Additionally, robust encryption methods guard your data during transmission and storage.

Regulatory Compliance Issues

Navigating the maze of regulations is no easy feat, but it’s absolutely essential. Open banking is tightly regulated, with mandates like PSD2 setting stringent requirements. Compliance involves aspects like Secure Customer Authentication (SCA) and regular security audits. Feeling overwhelmed by regulatory jargon? Open banking software often includes compliance modules to simplify these requirements. These modules automate processes like audit trails and reporting, ensuring you remain compliant without the headache. Also, regulatory bodies frequently update rules, and open banking platforms adapt swiftly to these changes, keeping you in the loop.

Wondering how all this plays out in real-world applications? Businesses using open banking software can streamline their operations and comply with regulations effortlessly, even when dealing with unsecured business loans. The software ensures that all transactions meet the latest compliance standards.

Questions lingering in your mind? Ponder about the peace of mind knowing your financial data is both secure and compliant. Open banking platforms take the complexity out of the equation, letting you focus on what truly matters.

Future Trends in Open Banking

The landscape of open banking is evolving rapidly, bringing forward exciting predictions and innovations. Expect enhanced security measures through advanced AI-driven threat detection systems, making your financial data even safer. Imagine seamless integration across multiple financial services and platforms with improved APIs, creating a more cohesive experience for users.

Payment services will see further automation, reducing the time and effort you need to invest. Sophisticated data analytics will offer businesses—including those offering unsecured business loans—new ways to assess creditworthiness and financial health swiftly. Personal financial management tools will get smarter, providing you with real-time insights tailored specifically to your financial behavior.

Regulatory frameworks will likely adapt to include more dynamic compliance solutions, making it easier for financial institutions to adhere to new rules while still focusing on enhancing user experiences.

Feeling curious about how these changes impact you? They promise not only to make financial interactions safer but also smarter. Consider how automated services can simplify your life and free up your time for more important activities. Interactive and personalized, the future of open banking is set to be a game-changer in the financial industry.

Concluding

Open banking software is revolutionizing the financial services industry by enhancing transparency, convenience, and innovation. With robust security protocols and real-time data access, it offers a promising future for both consumers and financial institutions. As you learn and grow, staying informed about providers like Tink, Plaid, and True Layer can help you leverage the benefits effectively. Future trends point towards even greater security, seamless integration, and smarter financial management tools. Embrace these advancements to ensure a safer and more efficient financial experience.